So, you're thinking about diving into the world of homeownership? That's exciting, man! But before you start house hunting, you gotta know the drill. Chase mortgage pre-approval is like your golden ticket to the real estate game. It's not just a formality—it's a crucial step that can save you time, money, and headaches. Let me break it down for ya. This is gonna be a wild ride, but trust me, by the end of this, you'll be a pro at navigating the mortgage process.

Now, you might be wondering, "Why should I care about Chase mortgage pre-approval?" Well, my friend, it's simple. A pre-approval is like a VIP pass that tells sellers and real estate agents you're serious business. It shows them you've got the financial backing to make an offer on a home. Plus, it gives you a clear idea of how much you can afford, so you don't waste time looking at houses out of your price range. Let's face it, nobody wants to fall in love with a house they can't buy, right?

Here's the deal: getting pre-approved isn't as scary as it sounds. In fact, it's pretty straightforward if you know what to expect. Chase makes it super easy with their streamlined process, and I'm here to guide you through every step. From understanding the requirements to submitting your application, we'll cover it all. So, buckle up, grab a snack, and let's dive into the world of Chase mortgage pre-approval.

Read also:Hikaru Nagi Step Your Ultimate Guide To Mastering The Art

What is Chase Mortgage Pre-Approval?

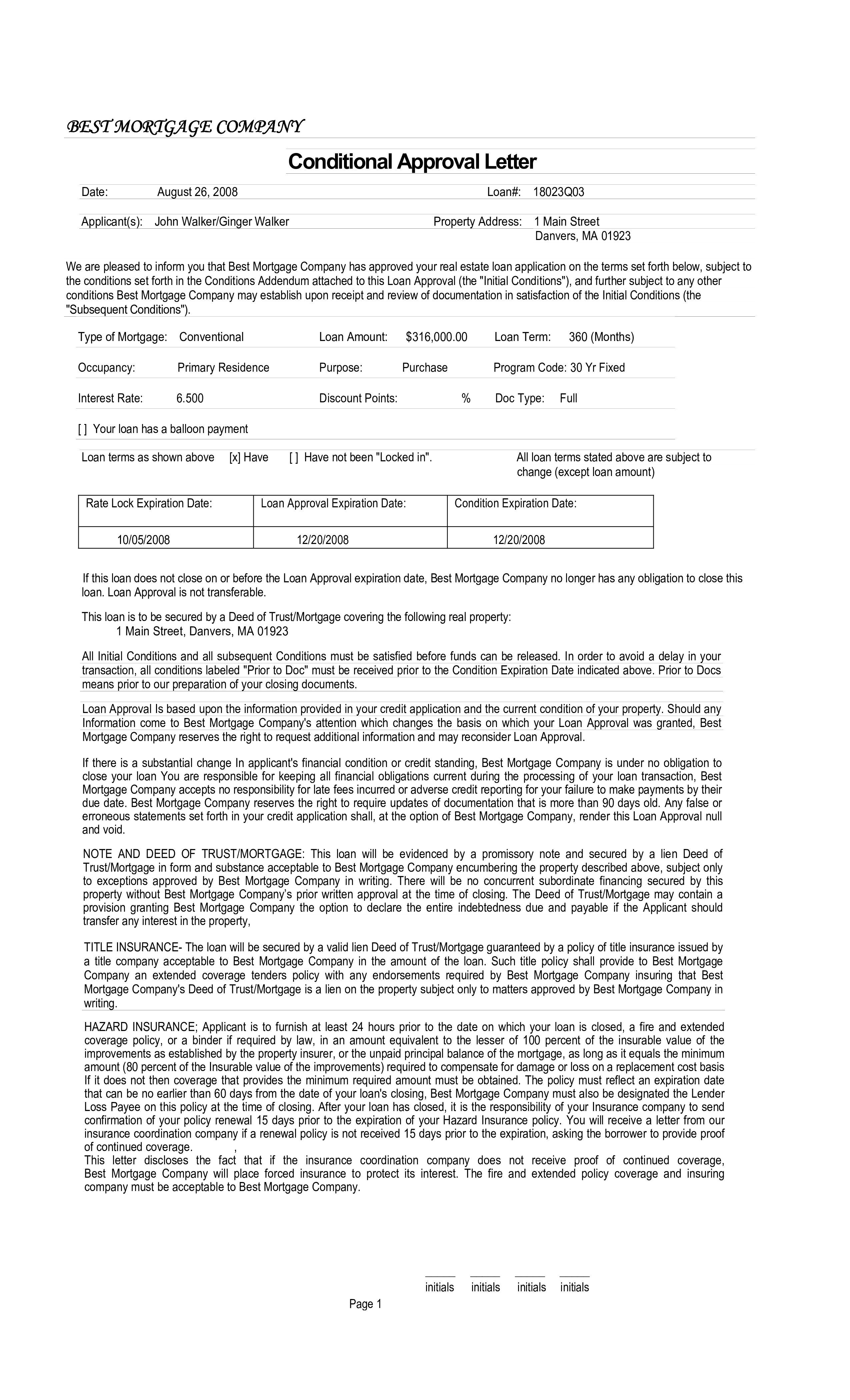

Alright, let's start with the basics. Chase mortgage pre-approval is essentially a lender's way of saying, "Hey, based on the info you've given us, we think you're a good candidate for a mortgage." It's more than just a nod of approval—it's a formal assessment of your financial situation. Chase will review your credit score, income, debts, and other factors to determine how much they're willing to lend you. Think of it as a dry run for the actual mortgage application process.

Why Does Chase Pre-Approval Matter?

Here's the thing: in today's competitive housing market, having a Chase pre-approval letter is like carrying a weapon. It gives you an edge over other buyers who haven't taken this step. Sellers love it because it shows you're financially qualified to close the deal. Plus, it helps you avoid last-minute surprises during the underwriting process. Bottom line? Chase mortgage pre-approval is your secret weapon in the homebuying game.

How Chase Pre-Approval Works

Let's break it down step by step. When you apply for Chase mortgage pre-approval, you'll need to provide some key info. This includes your income, assets, debts, and credit history. Chase will then review this information to determine your borrowing capacity. Once they've crunched the numbers, they'll issue a pre-approval letter that outlines the loan amount you qualify for. It's that simple.

Requirements for Chase Mortgage Pre-Approval

Now, let's talk about what Chase needs from you. Here's a quick list of the essentials:

- Proof of Income: Pay stubs, W-2 forms, or tax returns.

- Bank Statements: Chase will want to see your financial history.

- Credit Score: A good credit score can boost your chances of approval.

- Employment History: Stability in your job can work in your favor.

- Assets: Any savings, investments, or other financial resources.

Keep in mind, Chase may have specific requirements depending on the type of loan you're applying for. For example, if you're going for an FHA loan, you'll need to meet certain criteria. Always double-check with Chase to ensure you have everything they need.

Benefits of Chase Mortgage Pre-Approval

Okay, so why should you bother with Chase mortgage pre-approval? Here are some solid reasons:

Read also:Jemeliz Onlyfans Content The Rise Of An Influencer In The Adult Entertainment Industry

- Confidence: Knowing your budget upfront gives you peace of mind.

- Competitive Edge: Sellers are more likely to take you seriously.

- Transparency: You'll have a clear understanding of your financial limits.

- Time-Saving: You won't waste time looking at homes you can't afford.

Plus, Chase offers some pretty sweet perks, like flexible loan options and competitive interest rates. It's like getting a custom-tailored mortgage just for you.

Steps to Get Chase Mortgage Pre-Approval

Ready to get started? Here's how you can get Chase mortgage pre-approval:

Step 1: Gather Your Documents

Before you apply, make sure you have all the necessary documents ready. This includes proof of income, bank statements, and any other financial info Chase might need. The more prepared you are, the smoother the process will be.

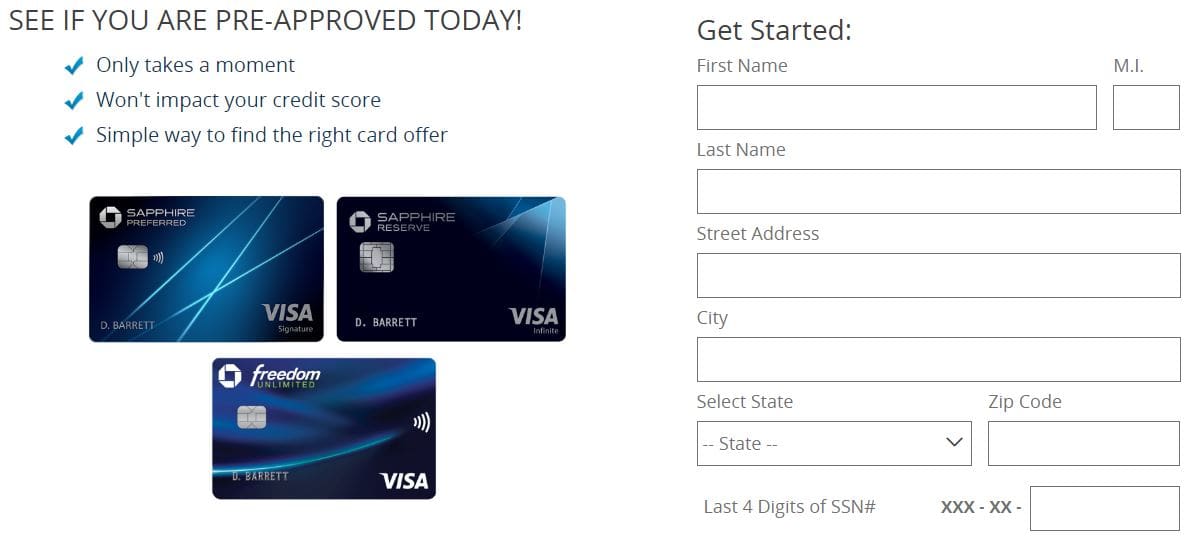

Step 2: Apply Online or In-Person

Chase makes it super easy to apply for pre-approval. You can do it online through their website or visit a local branch. Both options are straightforward and user-friendly. Just fill out the application form and upload your documents.

Step 3: Wait for Approval

Once you've submitted your application, Chase will review your info and decide whether to approve you. This usually takes a few business days, but sometimes it can be faster. Keep an eye on your email for updates.

Step 4: Receive Your Pre-Approval Letter

If you're approved, Chase will send you a pre-approval letter. This is your golden ticket to the housing market. Keep it safe and use it when you're ready to make an offer on a home.

Common Questions About Chase Mortgage Pre-Approval

Got some burning questions? Here are some FAQs to help you out:

How Long Does Chase Pre-Approval Take?

Typically, Chase pre-approval can take anywhere from a few hours to a few days. It depends on how quickly you provide the required documents and how busy Chase is at the time.

Is Chase Pre-Approval Free?

Yes, Chase doesn't charge a fee for pre-approval. It's a complimentary service they offer to help potential homebuyers. So, don't let anyone tell you otherwise.

Can I Get Pre-Approved Without a Credit Check?

Not really. Chase will need to run a credit check to assess your financial standing. But don't worry, it's a soft inquiry, so it won't hurt your credit score.

Chase Mortgage Pre-Approval vs. Pre-Qualification

Let's clear up the confusion. Chase mortgage pre-approval and pre-qualification are not the same thing. Pre-qualification is more of a rough estimate based on the info you provide. It's like a quick handshake with the lender. Pre-approval, on the other hand, is a deeper dive into your finances. It involves verifying your documents and gives you a more accurate picture of what you can afford.

Tips for a Successful Chase Mortgage Pre-Approval

Here are some pro tips to increase your chances of getting approved:

- Boost Your Credit Score: Pay off any outstanding debts and keep your credit utilization low.

- Stabilize Your Income: Avoid job hopping if possible. Lenders love stability.

- Save for a Down Payment: The more you put down, the better your chances of approval.

- Be Honest: Don't hide any financial info from Chase. Transparency is key.

Chase Mortgage Pre-Approval and the Housing Market

Now, let's talk about how Chase mortgage pre-approval fits into the larger housing market. In today's fast-paced real estate world, having a pre-approval letter can make all the difference. It shows sellers you're serious and financially capable. Plus, it gives you the confidence to negotiate and make offers without hesitation. Chase's pre-approval process is designed to empower you in this competitive landscape.

Conclusion: Take Action Today

So, there you have it. Chase mortgage pre-approval is your key to unlocking the door to homeownership. It's a simple yet powerful tool that can make your homebuying journey smoother and more successful. Now that you know the ins and outs, it's time to take action. Apply for pre-approval, start house hunting, and make your dreams a reality.

Before you go, I want to leave you with a challenge. Share this article with a friend who's thinking about buying a home. Knowledge is power, and spreading the word can help others succeed in their homebuying journey. And hey, if you have any questions or feedback, drop a comment below. I'd love to hear from you!

Table of Contents

- Chase Mortgage Pre-Approval: The Ultimate Guide to Unlock Your Dream Home

- What is Chase Mortgage Pre-Approval?

- Why Does Chase Pre-Approval Matter?

- How Chase Pre-Approval Works

- Requirements for Chase Mortgage Pre-Approval

- Benefits of Chase Mortgage Pre-Approval

- Steps to Get Chase Mortgage Pre-Approval

- Common Questions About Chase Mortgage Pre-Approval

- Chase Mortgage Pre-Approval vs. Pre-Qualification

- Tips for a Successful Chase Mortgage Pre-Approval

- Chase Mortgage Pre-Approval and the Housing Market

- Conclusion: Take Action Today

![Chase Credit Card PreApproval (How to get offers) [2020] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2018/04/Chase-Credit-Card-Pre-Approval.png)